Way More Than a Storefront

Last week I was in Las Vegas with some family. We were at dinner and the table next to us included a person who had very strong opinions about Amazon. I can relate. He stated, “Amazon is not a key player in the economy because they do not produce a good”. While this man continued his unofficial Ted talk, I could not stop shaking my head. I got to thinking that this is likely one of many misunderstandings about Amazon. It’s comparable to the lack of understanding that ESPN is owned by Disney. So I wanted to evaluate a couple of areas where Amazon is completely dominating, but somewhat hidden from the general public.

I would be remiss to not begin with Amazon Web Services or AWS as it’s more commonly known. AWS is the cloud computing branch of Amazon that offers storage, hosting, and CRM Solutions. Most have likely never heard of AWS as, unless you work in the tech space, you simply don’t “need” it. However, AWS was born out of Amazon’s own needs. If we look at Alexa.com (which is owned and operated by Amazon), Amazon is the 11th most visited website in the world. If we look at just the United States, it’s the third most visited site in the world. All of that traffic alone takes a powerful server solution but when you need it to power a storefront that is used by millions of sellers and access as an ad platform, you’re going to need some muscles.

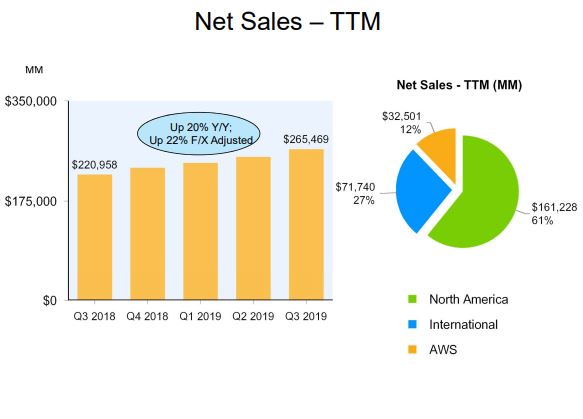

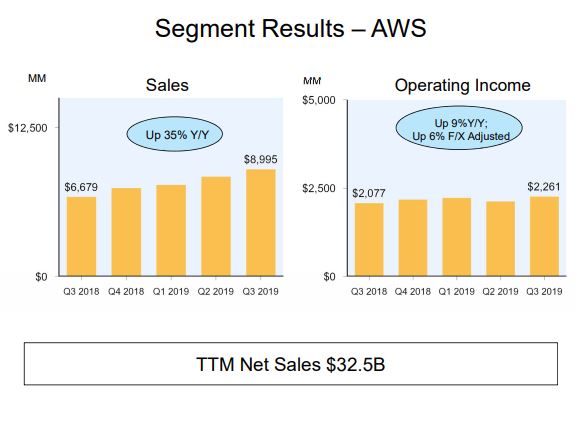

So how valuable is AWS? According to the Q3 2019 Investor slides from Amazon, we can see that up 20% for Amazon. What made up 12% of that growth? AWS. According to the same documentation, AWS net sales year over year was $32.5 billion. Billion…with a b. How big is that number in comparison to its competitors? According to Intellipaat, AWS has about 30% of the cloud market. Number 2 is Azure from Microsoft with about 16%. This is a huge part of the Amazon story and my sense that unless you work in tech or happen to be an Amazon nerd, you would have no idea.

I had CNBC on yesterday and one of the hosts, while speaking on Amazon, mentioned the recent developments with the JEDI (Joint Enterprise Defense Infrastructure) contract. This contract, to my understanding, is to bring in a new age of cloud computing the Department of Defense. In October, it was announced that Microsoft (Azure) had won the contract. A month later Amazon submitted a formal protest. The protest itself is black lined heavily but the long and short of it is President Trump has a strong dislike to Amazon CEO, Jeff Bezos, and the Washington Post, which is owned by Amazon. Therefore Amazon lost the contract more than Microsoft won it. Whether any of this is true is up to the U.S. Court of Appeals but the CNBC host made a statement that I think is important. She stated, “For Amazon, this is less about the money and more about being involved in future development with the government.” At first, that seems laughable. 10 billion is certainly not a small amount but AWS isn’t exactly hurting for money. Her point represented Amazon as a whole. To own every piece of as many verticals as possible.

Let’s bring this back to earth for a minute. Most are familiar with buying on Amazon. You go onto Amazon.com, find the item you are looking for, put it in your cart, and make the purchase. If you have normal shipping, then you can expect to receive your item in 3-5 days. If you are an Amazon Prime customer, you expect to get that item in 2 days. Now I’m skipping a ton of variables here. For example, advertising on Amazon, which is expected to be a 6.6 billion dollar industry for Amazon. I also skipped the Buy Box. The semi-mysterious process of which seller gets to be the one to actually sell the product on Amazon. However, for now, let’s just think of your experience of buying the product. There is a huge step between you hitting purchase, and you getting the item. Logistics. The process of actually getting the item to your door is a spot where Amazon didn’t have much control. However, Amazon likes to own the whole process. The same way Apple likes to control its ecosystem.

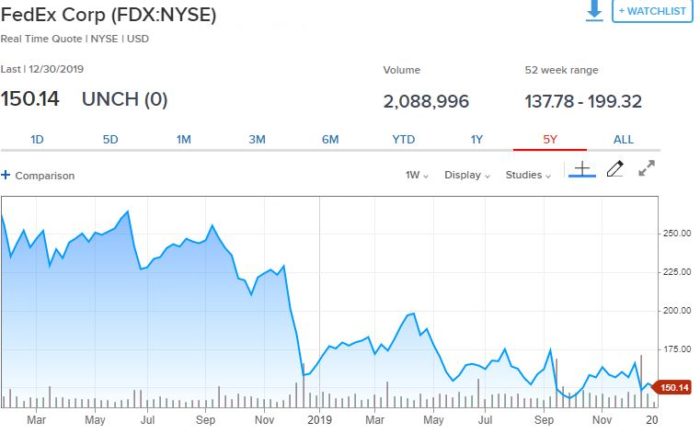

Amazon is now delivering 2.5 billion packages per year. FedEx stock was trading at about $270 a share in February 2018 as Amazon started its logistics business. Now? $150. Professor Scott Galloway of NYU predicts FedEx will be acquired by Wal-Mart, but also threw out the idea of Shopify which would be very interesting.

So now we’ve established that Amazon is a storefront, a cloud computing company, and rapidly expanding as a logistics company. Amazon also owns a large number of other companies such as Whole Foods, and Ring. This further shows how Amazon is trying position to be the vertical of your life. You may own an Echo device so you can use voice to place orders. As a Prime member, you are incentivized to shop at Whole Foods. When you buy online their own logistics gets you your item in 2 days or even 1 day in some circumstances. Amazon even has its own operating system known as Fire. My prediction? In the next 2 years, Amazon will sell its own version of the Chromebook with Fire as the OS. They are already in the tablet market so I’m not exactly swinging for the fences here, but a computer is marketed very differently than a tablet and getting users to browse, search, and buy on Fire would almost complete the circle of Amazon dominance.

This all comes back to the question of “Is this a good thing?” I’m not here to answer that question (quick answer: not in terms of market competitiveness but for Amazon customers, most definitely) but what I do know is this, that guy claiming Amazon had no impact on the economy, he could not have been more wrong.

Want to share this post on Bluesky? I made a button for that :).